Credit and debit card frauds are not new. What remains new is the innovative ways fraudsters find to steal information from credit and debit cards. The latest in such attempts is card ‘skimming’.

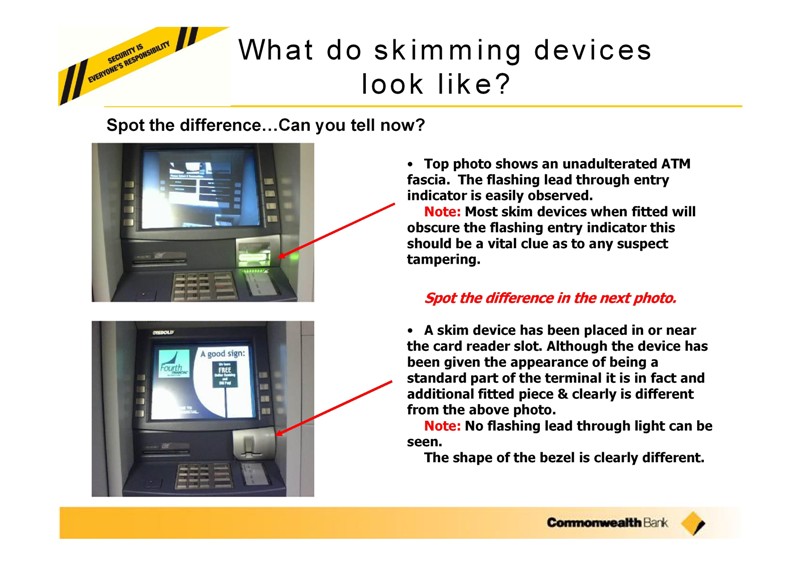

Skimming is a technique in which your card’s data via stolen via replication. Basically, your card is cloned using a ‘skimmer’. A skimmer is a device attached to the card reading slot such that it is not visible. Once you insert your card into the slot, it copies the details of your card.

In the past, similar incidents were reported where the victims received messages about money being debited from their accounts. Some of these transactions were also carried out overseas. In one case multiple users of the same ATM lost money. The fraudsters seem to start small by withdrawing small amounts of money and then suddenly they withdraw huge sums.

Fraudsters use a skimmer and a pinhole camera to capture the necessary data. Even if a skimmer manages to copy the data of your card, they cannot use it unless they have your PIN. This is where the camera is used. It is usually installed above the keypad and records the PIN as you type it in.

Skimming is not restricted to ATMs only. It can also happen at retail merchant outlets like shops and petrol pumps. Basically, at any place that you use your card. Your card can get stealthily swiped on a skimming machine after it is swiped on the actual payment machine.

After the arrest of one such fraudster, it was revealed that the skimming machines are available online. There are websites that also sell credit/debit card details online for a nominal fee. It has also been found that after some basic questioning by the seller (just to confirm that the buyer is not from any law enforcement agency), the goods are sold to almost anyone at very low prices. For example, a skimming machine that was retrieved from an ATM in Kalina, Mumbai was sourced from Hong Kong for less than $100. The online buyers and sellers are difficult to catch online as they use a complex network of go-betweens so that they are never traced. Also, they use code words like ‘switch’ to refer to skimming machines.

Another method that fraudsters use to cheat customers is by targeting them in the ATMs itself. They use some transparent glue to jam one of the buttons. The customer will find out that the button is not working only after swiping the card and entering his PIN. In such a case, one of the fraudsters standing behind the man in the line will tell that the machine is jammed. The man thus leaves the ATM without cancelling the transaction and the fraudsters then remove the glue and complete the transaction by withdrawing money.

Some precautions can be taken by card users so that their data is always secure.

- Before swiping your card at an ATM, ensure that no external devices are attached to the machine.

- Always use ATMs that have a security guard present.

- While entering your PIN cover the keypad with the other hand. This will go a long way in protecting your details.

- While giving your card to others to swipe, like at restaurants or shops, ensure that it is swiped only once.

- Don’t use cyber café machines for online shopping.

- While traveling on vacation, carry cash instead of cards.

- Finally, do NOT share your card details with anyone.

Security experts now highly recommend using cards that have chips in them instead of the ones with the magnetic strip. The police also need to work on a global level if these fraudsters have to be caught. Awareness about such crimes has increased and there has been a reduction in the number of reported cases of card cloning. In the meantime, we can do all that we can to ensure that our card details are not compromised in any way.